This report, by Dahm, J. Michael, U.S. Naval War College Digital Commons, provides a comprehensive assessment of Chinese civilian shipping support to the People’s Liberation Army (PLA), examining civil maritime-military activities in 2023. As of 2023 and probably through at least 2030, the PLA’s reserve fleet of civilian ships is probably unable to provide the amphibious landing capabilities or the over-the-shore logistics in austere or challenging environments necessary to support a major cross-strait invasion of Taiwan. However, 2023 activity has demonstrated significant progress toward that end. In addition to the extensive use of civilian ferries, this report identifies the first use of large deck cargo ships to support PLA exercises. While not as capable as large, ocean-going ferries, China’s civil fleet boasts dozens of large deck cargo ships and may provide the PLA with the lift capacity necessary to eventually support a large crossstrait operation. This report also discusses other civil maritime-military activities including “surge lift events,” coordination and synchronization of multi-theater events, floating causeway developments, and the dedicated use of civilian ships for intra-theater military logistics.

This report is a follow-on to China Maritime Report No. 16 and China Maritime Report No. 25, which assessed PLA use of civilian shipping for logistics over-the-shore (LOTS) and amphibious landings between 2020 and 2022.1 Like its predecessors, this report analyzes commercially available ship tracking data, satellite imagery, media reporting, and other open-source materials to assess the capabilities of PLA logistics troops and supporting civilian ships. This report on 2023 activity provides a comprehensive examination of a second full year of Chinese civil maritime-military events. Examining these civil maritime-military events over time offers a greater understanding of the diversity of civil maritime-military events and how they may be prioritized by the PLA. This analysis of another complete year of activity lays a foundation for future studies of Chinese civil maritime-military training activities. Civil maritime-military training in 2023 appeared to build on 2022 port-to-port lift training to include a greater diversity of RO-RO ships, specifically large deck cargo ships. Summer 2023 training with these ships was marked by what this report calls “surge lift events,” i.e., events or logistics exercises that involve a relatively large number of civilian ships conducting significant lifts over just a few days. As in years past, the PLA continued to train with civilian vessels as auxiliary amphibious assault ships for offshore beach landings. Training with the PLA’s floating causeway system for over-the-shore logistics continued in 2023 and was noted for the first time on Hainan Island. As in previous years, 2023 military training involving merchant ships culminated in the PLA’s annual large-scale amphibious landing exercise. Satellite imagery identified several PLA Navy (PLAN) amphibious ships that probably participated in the civil maritime-military event. The substance and scale of the 2023 capstone exercise suggests that the PLA remains limited in its ability to employ civilian RO-RO ferries and deck cargo ships as part of a major assault against Taiwan. Of note, 2023 did see increased inter-theater coordination including synchronized civil maritimemilitary events across the PLA’s military theaters. Many of the ships, and presumably crews, that participated in 2023 events had not previously supported military activity, indicating the PLA may be attempting to increase the level of military experience across China’s civil fleet. The PLA continues to advance core capabilities for the large-scale lift of PLA troops and equipment into undefended, captured ports, capabilities that may be leveraged in a cross-strait invasion of Taiwan.

Other findings include:

The first detected use of large deck cargo ships to support military activity was in July 2023. (See pages 10-12)

Surge lift events appeared to dominate the 2023 summer training cycle. (See pages 12-22)

Surge Lift Event One consisted of fourteen ships—five large RO-RO ferries, two general cargo ship, and seven deck cargo ships—in a one-way lift of as many as 1,000 military vehicles and 2,000 personnel over just three days. This event was probably synchronized with a RO-RO ferry military event in the Southern Theater.

Surge Lift Event Two consisted of eight ships in the PLA’s Eastern Theater—four large RO-RO ferries and four deck cargo ships conducting two rapid round-trip lifts over three days. This activity appeared to be synchronized with a Northern Theater surge lift event involving seven ships—five large RO-RO ferries and two general cargo ships.

A deck cargo ship-mounted “variable height loading ramp” was identified; it may allow for offloading RO-RO ships in austere ports regardless of tidal variations. (See pages 14-17)

The PLA continued exercising an improved floating causeway system, used by RO-RO ships to deploy forces directly into a beach landing area. A new-construction barge was also identified that may eventually serve as a dedicated offload platform for the causeway. (See pages 25-29)

The annual amphibious landing capstone exercise held in September 2023 was more complex than the 2022 exercise with the addition of a third civilian ship group. (See pages 30-38)

The number of civilian vessels involved in the 2023 exercise increased to sixteen, up from eight in 2021 and ten in 2022.

Three RO-RO ferries conducted offshore launches of amphibious vehicles or assault boats, down from four RO-RO ferries that deployed forces at sea in the 2022 exercise.

The annual Tianjin loading exercise was executed in October 2023, but on a much smaller scale than was observed in 2022. (See pages 38-39)

A RO-RO ferry has been identified that likely provides fulltime support for Southern Theater logistics. Two civilian ships also continued to provide dedicated logistics support for the PLA’s artificial island outposts in the South China Sea. (See pages 39-42)

A large deck cargo ship observed participating in military events in 2023 was modified and employed as an offshore space launch platform in December 2023. (See pages 42-43) This report comprises five sections and two appendices. Section one provides a brief overview of events observed in 2023. Sections two through five present detailed analysis of four categories of observed events: (2) The use of deck cargo ships and surge lift events, (3) amphibious landing training and floating causeway developments, (4) the 2023 amphibious landing capstone exercise, and (5) other notable civil maritime-military developments in 2023. The report concludes with Appendix A, a listing and description of Chinese merchant ships observed participating in civilmilitary activity, and Appendix B, describing Chinese ports that support civil-military activity.

Chinese Merchant Ships Supporting Civil-Military Activity

Tables 19-24 list ships owned, operated, or managed by companies that have been observed through open-sources and commercial sources providing logistics support to the PLA or participating in Chinese military exercises since at least 2020. Ship data provided includes:

MMSI – Maritime Mobile Service Identity number / Automatic Identification System (AIS) number.

IMO – International Maritime Organization number.

Gross Tonnage – A calculated measurement of a ship’s internal volume where a vessel “ton” is 100 cubic feet.

Deadweight Tonnage (DWT) – Number of metric tons (1000 kg/2204 lbs.) of cargo, stores, and fuel a vessel can transport.

Vehicles – “Vehicle” numbers provided by RO-RO ferry companies or ship manufacturers probably refer to a mix of cars and trucks. For vehicle carrier ships, this is assumed to refer to a car equivalent unit (CEU), 4 meters by 1.5 meters. A ship’s military vehicle capacity, including heavy armor and oversized vehicles, is likely less than advertised vehicle numbers.

Lanes in Meters (LIM) – A measurement of a RO-RO ship’s vehicle lanes, conventionally with a 2-meter-wide lane. (1 LIM = 2 square meters, 2000 LIM = 4000 square meters of vehicle deck space).

The civil maritime industry is organized around an often-complex array of owners, managers, joint ventures, and front companies. Civilian ships observed supporting military activities during 2023 fall into three ownership categories: 1) RO-RO ferries owned by the publicly traded Bohai Ferry Group corporation, 2) privately-owned deck cargo ships, and 3) ships that are ultimately owned by large Chinese state-owned enterprises (SOEs) such as the China Ocean Shipping Company (COSCO) or China Merchants Group. This appendix delineates subsidiary companies and managers that appear to be directly responsible for day-to-day operations of ships noted supporting civil maritime-military activity in 2023. Ships supporting civil maritime-military activity are probably paid for their participation through charter contracts. Most of these ships also likely enjoy some legal protection as members of the Maritime Militia. Bohai Ferry Group ships are organized into the Militia’s “Eighth Transport Dadui” (海运八大队). The China Merchants vehicle carriers reportedly constitute the “Fifth Transport Dadui” (海运五大队). RO-RO ferries servicing Hainan Island may constitute the “Ninth Transport Dadui” (海运九大队).

RO-RO Ships – Bohai Gulf Ferry Routes

Over two dozen roll-on/roll-off passenger (ROPAX) ferries provide regular service across the mouth of China’s Bohai Gulf. All of these large ocean-going vessels have at least two vehicle decks. They also have external doors that close and seal to create a high-water line, increasing their ability to operate safely in heavy seas. Different classes of RO-RO ferries are shown in Figure 36.

Bohai Ferry Group – Bohai Ferry Group Co. Ltd. (渤海轮渡集团股份有限公司) and its subsidiaries own and operate fourteen RO-RO ferries across the Bohai Gulf. ROPAX ferries fall directly under the Bohai Ferry Group. BO HAI YIN ZHU was inactive throughout 2023 and remains pierside in Yantai. BO HAI JIN ZHU, provides cargo service under the subsidiary Tianjin Bohai Ferry Shipping Co., Ltd. (天津渤海轮渡航运有限公司). BO HAI MING ZHU was sold to a Turkish company and renamed LIDER EXPRESS. Purpose-built RO-RO cargo ferries BO HAI HENG TONG and BO HAI HENG DA are owned by Bohai Hengtong Ferry Co., Ltd. (渤海恒通轮渡有限公司), a joint venture company between Bohai Ferry Group, Hengtong Logistics Corporation, and Longkou Port Group. ZHONG HUA FU QIANG suffered a serious fire in its vehicle bay in April 2021. ZHONG HUA FU QIANG was repaired and returned to service in 2023 as the BO HAI HENG SHENG, probably as part of the the Bohai Hengtong Ferry Co. In 2020, Bohai Ferry Group acquired Weihai Haida Passenger Transport Co., Ltd. (威海市海大客运有限公司) and its RO-RO ferries.81 Weihai Haida’s SHENG SHENG 1 has been retired. Bohai Ferry Group ships are listed in Table 19.

COSCO Shipping – The China Ocean Shipping Co., Ltd. is a large Chinese SOE. The COSCO subsidiary COSCO Shipping Ferry Co., Ltd. (中远海运客运有限公司) owns and operates twelve ocean-going ferries that provide service across the Bohai Gulf. The HAI YANG DAO has been renamed MIN TAI ZHI XING and is apparently now providing ferry services from Xiaman up and down the Chinese coast. In 2022, COSCO Ferry Shipping took delivery of the SHUN LONG HAI, a purpose-built RO-RO cargo ferry similar to Bohai Hengtong Ferry cargo ferries. A second RO-RO cargo ferry, CHANG LONG HAI, entered service in 2023.83 COSCO Shipping (Qingdao) Co., Ltd. (中远海运(青岛)有限公司) operates a Chinese-flagged ROPAX ship that sailed between Yantai, China and Incheon, South Korea throughout 2022.84 COSCO Ferry ships are listed in Table 20.

RO-RO Ships—Qiongzhou Strait Ferry Routes and South China Sea Cruise Routes

Forty-eight ROPAX ferries provide regular service across the Qiongzhou Strait between mainland China and Hainan Island. These relatively small ROPAX ships carry up to sixty vehicles on a single vehicle deck. Due to Hainan’s tropical heat, the ferries have large openings in the sides of the hull and in the vehicle bay overheads for ventilation, a design that makes them dangerous to operate in heavy seas. Prior to COVID epidemic shutdowns, three ROPAX cruise ships offered South China Sea “eco-tourism” cruises from Sanya to the Paracel (Xisha) Islands. These three ocean-going cruise ships are similar in design to the Bohai Gulf RO-RO ferries (see Figure 37).

COSCO Shipping / Qiongzhou Strait Ferry Transportation – In 2021, 47 RO-RO ferries that operate across the Qiongzhou Strait were consolidated under the ownership of the COSCOcontrolled Qiongzhou Strait (Hainan) Ferry Transportation Co., Ltd. (琼州海峡(海南)轮渡运输有限公司).88 Qiongzhou Strait Ferry Transportation is a joint venture between provincial government-owned Guangdong Xuwen Strait Shipping Co., Ltd. (广东徐闻海峡航运有限公司), which contributed 29 ferries to the joint company, and COSCO subsidiary Hainan Strait Shipping Co., Ltd. (海南海峡航运股份有限公司), which contributed 18 ferries. COSCO’s Hainan Strait Shipping apparently has effective control of the joint venture with 51 percent of the voting rights.89 Following the 2021 consolidation, in March 2022, the joint company formed its own subsidiary, Qiongzhou Strait (Guangdong) Ferry Transportation Co., Ltd. (琼州海峡(广东)轮渡运输有限公司), which now owns all 29 ships originally contributed by Xuwen Strait Shipping.90 Qiongzhou Strait ferries appear in Table 21. COSCO Shipping – COSCO subsidiaries operate three ROPAX cruise ships likely chartered to support military activity in 2021 and 2022 after being rendered inactive by COVID-19 restrictions. Hainan Strait Shipping Co., Ltd. (海南海峡航运股份有限公司) owns and operates the CHANG LE GONG ZHU and QI ZI WAN. COSCO subsidiary Sansha Nanhai Dream Cruises Co., Ltd. (三沙南海梦之旅邮轮有限公司) owns and operates the NAN HAI ZHI MENG (Nanhai Dream).91 Cruise ships appear in Table 22.

Vehicle Carriers

Vehicle carriers, sometimes called pure car carriers (PCC) or pure car/truck carriers (PCTC), are large, ocean-going cargo ships with multiple decks of interior space maximized for transporting fleets of vehicles (see Figure 38). While seemingly optimal for moving large formations of military vehicles, they likely do not have facilities to accommodate large numbers of personnel (seating, kitchens, restrooms, etc.) for long at-sea periods. Some vehicle carriers have drafts greater than 30 feet (9 meters), limiting the ports that may be used for embarkation and debarkation. In 2022, large vehicle carriers were also in high demand for vehicle imports/exports and moving fleets of new vehicles to market within China, probably limiting their availability for military exercises.

Jiangsu Dafeng Port Holding Group – Jiangsu Dafeng Port Holding Group (江苏大丰海港控股集团) and Jiangsu Yueda Logistics Co., Ltd. (江苏悦达物流有限公司) own two large, ocean-going RO-RO vehicle carriers as part of a joint venture. One of these ships—DA FENG GANG LI MING HAO—has been noted supporting Chinese military activities since 2021.95 In 2023, DA FENG GANG LI MING HAO operated primarily between mainland China, South Korea, and Mexico and did not support military activity. Jiangsu Dafeng Port Holdings is a Chinese SOE primarily focused on port management and logistics. Yueda is a logistics company that provides auto shipping logistics for Dongfeng Yueda Kia automobile manufacturing company. The two Dafeng/Yueda vehicle carriers are managed by Weihai Sheng An Shipping Co., Ltd. (威海市升安海运有限责任公司).96 Weihai Sheng An manages four other large vehicle carriers (SHI HAI, SHI JIANG, SHI YANG, and SHI YUAN) for Kingfour Marine Co., Ltd. (中甫(上海)航运有限公司), a subsidiary of CDC International Logistics.97 There are no indications that the Kingfour vehicle carriers have supported Chinese military exercises and are not listed in Table 23.

China Merchants Group – China Merchants Guangzhou RO-RO Shipping Co., Ltd. (广州招商滚装运输有限公司) (CMRORO) is a joint venture created in 2019 by China Merchants Energy Shipping (70 percent share) and Guangzhou Automobile Group Business Co., Ltd. (30 percent).98 CMRORO operates 10 ocean-going vehicle carriers and several river vehicle carriers. Only one of these vehicle carriers, CHANG DA LONG, has been noted supporting the PLA since at least 2018.

COSCO Shipping – COSCO Shipping Specialized Carriers Co., Ltd. (中远海运特种运输股份有限公司) operates five large, ocean-going vehicles carriers. None of these ships have been noted supporting Chinese military activity. They are, however, included in Table 23 because of COSCO’s established relationship with the PLA. COSCO SHENGSHI and COSCO SHENGSHI are Panamaflagged vessels typically employed on long-haul international routes.

SAIC AnJi Logistics – SAIC Motors, China’s largest automaker, operates fourteen ocean-going vehicle carriers through SAIC AnJi Logistics Co., Ltd. (上汽安吉物流股份有限公司) and its shipping subsidiaries. None of these Chinese-flagged RO-RO vehicle carriers have been noted supporting Chinese military activity. Therefore, they are not included in Table 23.

General Cargo Ships, Deck Cargo Ships, and Barges

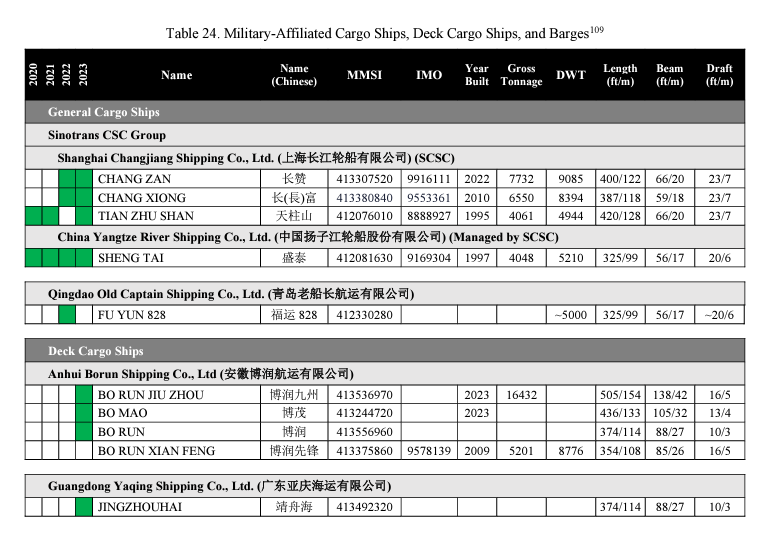

Several general cargo ships and barges supported Chinese military activity in 2023. Tugs and other utility craft employed during military exercises were probably hired from harbors near exercise areas. Examples of tugs used to assist with floating causeway operations in Dacheng Bay include GU GANG TUO 3 and GU GANG TUO 4 from the nearby port of Gulei. Cargo ships and barges that provided significant civil-military support are shown in Figure 39 and listed in Table 24.

China Merchants Group – In 2017, Sinotrans Limited and the Changjiang Shipping Corporation (CSC) (Sinotrans CSC Group) were acquired by China Merchants Group. CSC subsidiary Shanghai Changjiang Shipping Corporation (SCSC) (上海长江轮船有限公司) owns and operates two 8000 DWT-class general cargo ships, CHANG XIONG and CHANG ZAN, that provided yearround support to the PLA in 2022 and 2023. Each feature two 50-ton deck cranes. SCSC’s 5000 DWT-class general cargo ship TIAN ZHU SHAN supported PLA exercises in 2020 and 2021 and again in 2023. Another Sinotrans CSC Group subsidiary, China Yangtze River Shipping Co., Ltd. (中国扬子江轮船股份有限公司), owns the 5000 DWT-class general cargo ship SHENG TAI, which has supported PLA activity since at least 2020. SHENG TAI is currently managed by SCSC.

Privately-Owned Deck Cargo Ships – Several private shipping companies that own and operate deck cargo ships supported military activity in 2023. Few details are readily available on these shipping companies and what other ships they may own. Companies that own and operate deck cargo ships involved in 2023 civil maritime-military activity include the Anhui Borun Shipping Co., Ltd (安徽博润航运有限公司) that owns and operates at least four deck cargo ships, Guangdong Yaqing Shipping Co., Ltd. (广东亚庆海运有限公司), Taizhou Youjian Shipping Co., Ltd. (台州市友建船务有限公司), and Shanghai Zhenxin Shipping Co., Ltd. (上海振新船务有限公司).

China Communications Construction Corporation – China Communications Construction Corporation (CCCC) (中国交通建设股份有限公司) is a large Chinese SOE. The CCCC Third Engineering Co., Ltd. (中交三航局第三工程有限公司) operates the SAN HANG GONG 8, a semisubmersible barge that is normally used in port construction projects.107 SAN HANG GONG 8 is used as the docking/transfer platform for the PLA’s floating causeway system. Unknown Owners – Ownership and management could not be determined for the deck cargo ships HENG DA FA ZHAN, XINHAISHENG 8, HUAYI003, HUAYI008, or HUAYI009. The owner of the new-construction self-propelled barge E SHAN has also not been identified.

Chinese Ports Supporting Civil-Military Activity

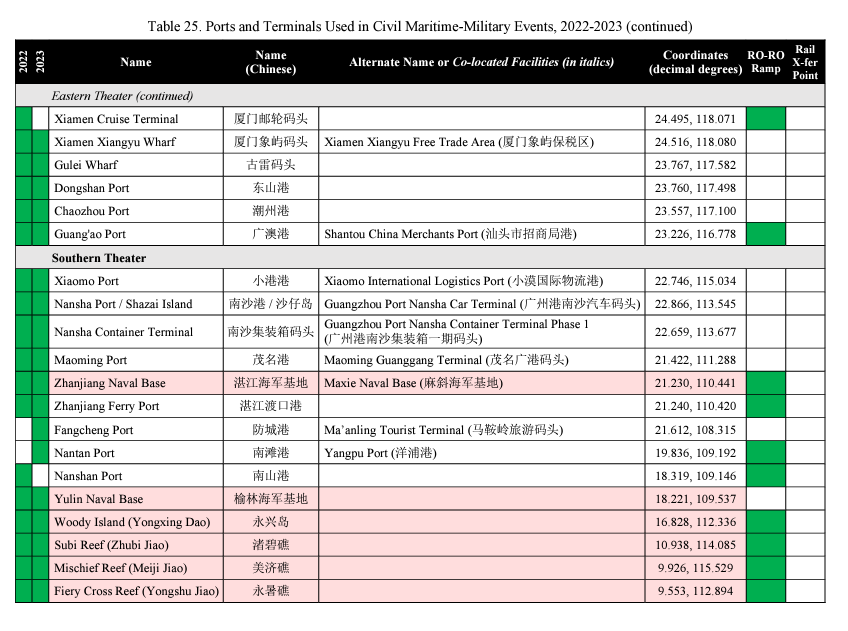

Observed activity in 2023 included activity at thirty-two ports and terminals used by civilian RO-RO and cargo ships to support military activity. These comprise twenty-six civilian facilities as well as six PLAN bases. Table 25 lists ports and terminals used by the PLA in civil maritime-military events in 2022 and 2023. Those ports and terminals, less the three main South China Sea Spratly Island bases (Fiery Cross, Subi, and Mischief Reefs), are shown in Figure 41. Analysis of civil maritimemilitary activity from 2020-2021 revealed no additional ports or terminals used beyond those listed in Table 25.110 Table 26 lists the seventeen ferry terminals that facilitate services across the Bohai Gulf and between the Chinese mainland and Hainan Island. These civilian terminals have also been used for military activity. The relatively new RO-RO ferry SHUN LONG HAI established regular service between the Bohai ports of Bayuquan and Weifang. Therefore, since the 2022 report, “More Chinses Ferry Tales,” Weifang has been moved from the “civil-military activity” list to the “ferry terminal” list. However, Weifang was used to support military activity at least four times in 2023. Many of the ports and terminals listed in Tables 25 and 26 have one or more “RO-RO ramps.” These are either mechanical ramps that connect to a quay wall or pier, or a concrete ramp that extends into the water. These ramps help RO-RO ship onboard vehicle ramps compensate for rising or falling tides. In ports without RO-RO ramps with significant tidal variations, RO-RO ship docking may need to be timed with high tides. Many of the ports and terminals listed in Tables 25 and 26 are also identified as having a rail transfer point (“Rail X-fer Point”). These are railroad spurs located in the port or terminal area that may allow the PLA to move military vehicles, especially heavy armor, in and out of ports via rail. Several civilian ferry terminals also accommodate train ferries, onto which rail cars carrying vehicles and cargo can be loaded directly onto a ferry. Rail transfer capabilities allow for moving tanks and other heavy equipment that would otherwise require an excessive amount of fuel to move long distances under their own power. In lieu of rail, tanks must normally be moved by heavy equipment transport (HET). Figure 40 shows tanks and other armored vehicles loading onto flat-bed rail cars after unloading from the RO-RO ferry ZHONG HUA FU XING in Qinhuangdao in October 2021.

Dahm, J. Michael, "China Maritime Report No. 35: Beyond Chinese Ferry Tales: The Rise of Deck Cargo Ships in China's Military Activities, 2023" (2024). CMSI China Maritime Reports. 35.

Comments